Delving into the realm of financial strategies, this article explores the differences between debt financing and revenue-based financing in the year 2025. As we navigate through the intricacies of these two options, a clearer picture emerges of the optimal choices for businesses seeking funding in the upcoming year.

With a focus on understanding the nuances of debt financing and revenue-based financing, this discussion aims to shed light on the advantages, drawbacks, and trends that will shape financial decisions in the near future.

Overview of Debt Financing and Revenue-Based Financing

Debt financing and revenue-based financing are two common ways for businesses to raise capital. Debt financing involves borrowing money from lenders that must be repaid with interest over time, while revenue-based financing involves receiving funds in exchange for a percentage of future revenue.

Debt Financing

Debt financing is a method of raising capital by borrowing money from lenders, such as banks or financial institutions. The borrowed funds need to be repaid over time, along with interest payments. This form of financing typically involves a fixed repayment schedule, regardless of the company's revenue or profit levels.

One of the key characteristics of debt financing is that the lender does not have a claim on the company's future earnings.

Revenue-Based Financing

Revenue-based financing, on the other hand, is a type of funding where a business receives capital in exchange for a percentage of its future revenues. Unlike traditional debt financing, the repayment amount is tied to the company's revenue, meaning payments fluctuate based on how well the business is performing.

This form of financing is often used by startups or small businesses that may not qualify for traditional loans.

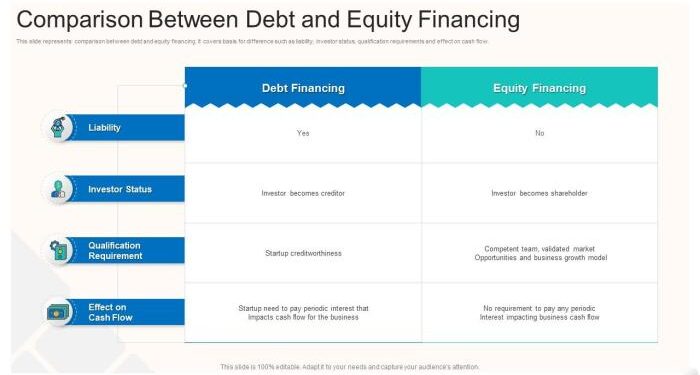

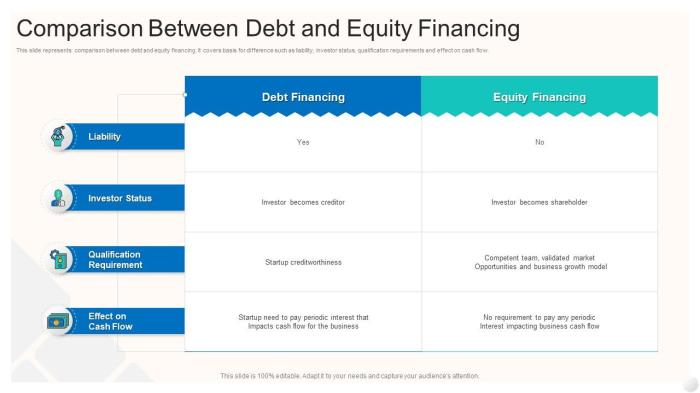

Main Differences

- Repayment Structure: Debt financing involves fixed repayment amounts over time, while revenue-based financing ties payments to the company's revenue.

- Risk Sharing: In debt financing, the lender does not share in the company's success, while in revenue-based financing, the investor shares in the upside of the business.

- Flexibility: Debt financing may have stricter repayment terms and requirements, whereas revenue-based financing can offer more flexibility based on the company's performance.

- Ownership Stake: Debt financing does not involve giving up equity in the company, while revenue-based financing may require a percentage of future revenue to be shared with the investor.

Pros and Cons of Debt Financing

Debt financing can be a beneficial option for businesses looking to raise capital, but it also comes with its own set of risks and drawbacks.

Advantages of Debt Financing

- Interest Tax Deductions: Interest payments on debt can often be tax-deductible, reducing the overall tax burden for the business.

- Retain Ownership: Unlike equity financing, taking on debt does not dilute ownership in the company, allowing the business owner to maintain control.

- Predictable Payments: Debt financing usually involves fixed interest rates and repayment schedules, making it easier to plan and manage cash flow.

Potential Drawbacks of Debt Financing

- Interest Payments: The business is obligated to make regular interest payments on the debt, which can add up over time and increase the overall cost of borrowing.

- Risk of Default: If the business is unable to meet its debt obligations, it can lead to default, damaging the company's credit rating and potentially leading to bankruptcy.

- Limited Flexibility: Debt financing often comes with covenants and restrictions that can limit the business's financial flexibility and decision-making abilities.

Examples of Suitable Situations for Debt Financing

- Expansion Projects: When a business is looking to expand its operations or enter new markets, debt financing can provide the necessary capital to fund these growth initiatives.

- Equipment Purchases: Financing the purchase of expensive equipment or machinery through debt can help spread out the cost over time while allowing the business to benefit from the use of these assets immediately.

- Working Capital Needs: Short-term debt financing can be useful for covering seasonal fluctuations in cash flow or addressing temporary funding gaps.

Pros and Cons of Revenue-Based Financing

Revenue-based financing offers several benefits for businesses looking for alternative funding sources. Unlike traditional debt financing, revenue-based financing does not require regular fixed payments, providing more flexibility for businesses, especially during uncertain economic times. Additionally, revenue-based financing allows businesses to align their repayment schedule with their cash flow, reducing the risk of default.

Benefits of Revenue-Based Financing

- Flexible Repayment: Revenue-based financing payments are directly tied to the business's revenue, allowing for more flexibility in repayment compared to fixed monthly payments in traditional debt financing.

- No Collateral Requirement: Revenue-based financing typically does not require collateral, making it accessible to businesses that may not have valuable assets to pledge.

- Shared Risk: Investors in revenue-based financing share the risk with the business, as repayment is based on the company's performance. This alignment of interests can lead to a more supportive relationship between the investor and the business.

Challenges of Revenue-Based Financing

- Higher Cost: Revenue-based financing can be more expensive than traditional debt financing in terms of the overall return to the investor, as they are taking on more risk by tying repayment to the business's revenue.

- Potential Revenue Constraints: Businesses that opt for revenue-based financing may face limitations on their growth potential, as a percentage of their revenue is allocated towards repayment, potentially impacting their ability to reinvest profits back into the business.

- Complex Terms: Revenue-based financing agreements can have complex terms and structures, which may require legal expertise to navigate effectively.

Risks of Revenue-Based Financing vs. Debt Financing

- Risk Sharing: In revenue-based financing, the investor shares the risk with the business, as repayment is contingent on the company's revenue. In contrast, debt financing carries the risk of default, where the business may be required to liquidate assets to repay the debt.

- Impact on Cash Flow: While revenue-based financing aligns repayment with cash flow, it may still impact the business's ability to reinvest profits, compared to debt financing where fixed payments can strain cash flow during lean periods.

- Growth Constraints: Revenue-based financing may limit a business's growth potential due to the percentage of revenue allocated for repayment, whereas debt financing provides a lump sum upfront that can be used for expansion without immediate revenue constraints.

Trends and Predictions for 2025

In 2025, the landscape of debt financing and revenue-based financing is expected to undergo significant changes due to evolving economic conditions and market trends.

Projected Trends in Debt Financing

Debt financing is expected to continue being a popular choice for businesses in 2025, especially for larger corporations looking to fund big projects or expansions. One of the trends that is likely to emerge is an increase in alternative lending options, such as peer-to-peer lending platforms and online lenders, offering more flexible terms and quicker access to capital.

- Traditional banks may face competition from these alternative lenders, leading to more competitive interest rates and loan terms.

- Companies might also explore sustainable finance options, with a focus on green bonds and sustainability-linked loans to align with ESG (Environmental, Social, and Governance) goals.

Expected Changes in Revenue-Based Financing

Revenue-based financing is anticipated to gain more traction in 2025, especially among startups and SMEs looking for non-dilutive funding options. One of the key changes could be a shift towards more tech-enabled revenue-based financing platforms, offering automated underwriting processes and personalized funding solutions.

- Investors might show a growing interest in revenue-sharing models, attracted by the potential for high returns based on the company's performance.

- The rise of revenue-based financing could also lead to more standardized contracts and industry benchmarks, making it easier for businesses to compare and choose the right financing option.

Impact of External Factors

External factors like economic conditions and regulatory changes could significantly impact both debt financing and revenue-based financing in 2025. A potential rise in interest rates could make debt financing more expensive, prompting businesses to explore other funding sources.

- On the other hand, economic uncertainties or market volatility might drive more companies towards revenue-based financing, which offers more flexibility in repayment based on revenue streams.

- Regulatory developments, such as changes in tax laws or financial regulations, could also influence the attractiveness of different financing options and shape the financing landscape in 2025.

Last Recap

In conclusion, the comparison between debt financing and revenue-based financing in 2025 reveals a landscape where strategic financial decisions can make or break a business. By weighing the pros and cons of each option and staying abreast of the latest trends, businesses can position themselves for success in the dynamic financial environment of the future.

Essential Questionnaire

What are the key differences between debt financing and revenue-based financing?

Debt financing involves borrowing funds that need to be repaid with interest, while revenue-based financing entails receiving funds in exchange for a percentage of future revenue.

When is debt financing a suitable option?

Debt financing is usually a good choice for established businesses with steady cash flow looking to expand or invest in growth opportunities.

What are the limitations of revenue-based financing?

One limitation of revenue-based financing is that it may result in businesses giving up a portion of their future revenue, potentially impacting profitability.

How can economic conditions impact debt financing and revenue-based financing in 2025?

Economic conditions in 2025 could influence interest rates for debt financing and the overall revenue potential for revenue-based financing, shaping the attractiveness of each option.