As Expert Predictions for JNJ Stock and JPM Stock in the Next 5 Years takes center stage, this opening passage beckons readers with casual formal language style into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

The content of the second paragraph that provides descriptive and clear information about the topic

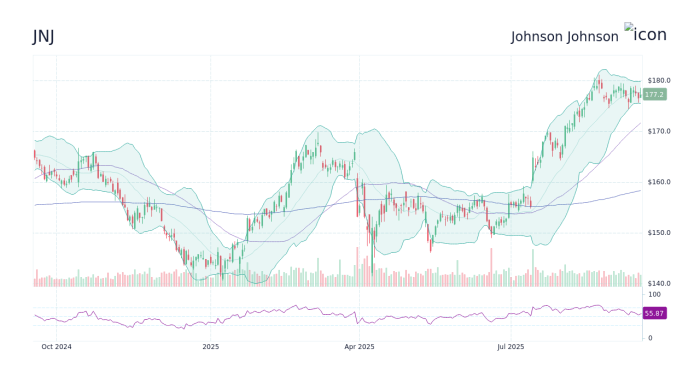

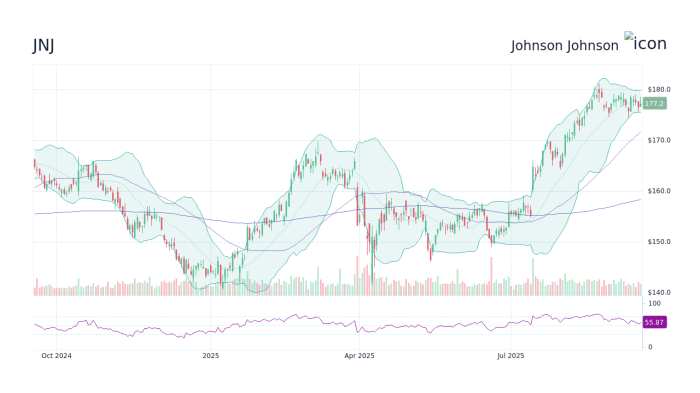

Expert Predictions for JNJ Stock in the Next 5 Years

Johnson & Johnson (JNJ) has a strong historical performance in the stock market, known for its stability and consistent growth over the years. The company is a leading player in the pharmaceutical, medical devices, and consumer health products industries.

Overview of JNJ’s Historical Stock Performance

- JNJ has shown steady growth in its stock price over the past decade, with occasional dips due to market fluctuations.

- The company's diversified portfolio and strong brand presence have contributed to its resilience during economic downturns.

- JNJ has a track record of paying dividends to its shareholders, making it an attractive investment for long-term investors.

Key Factors Influencing JNJ’s Stock Price

- Product innovation and development of new drugs and medical devices drive growth and revenue for JNJ.

- Regulatory approvals for new products can have a significant impact on the company's stock performance.

- Economic conditions and healthcare trends play a crucial role in determining JNJ's market value.

Expert Opinions on JNJ’s Future Growth Prospects

- Analysts are optimistic about JNJ's future growth potential, citing its strong pipeline of new products and expansion into emerging markets.

- The company's focus on research and development, coupled with strategic acquisitions, is expected to drive revenue growth in the coming years.

- Some experts believe that JNJ's commitment to sustainability and corporate social responsibility will enhance its reputation and attract more investors.

Potential Challenges Impacting JNJ’s Stock Value

- Increasing competition in the pharmaceutical and healthcare sectors could put pressure on JNJ's market share and pricing strategies.

- Regulatory changes and legal issues related to product safety or marketing practices may pose risks to JNJ's financial performance.

- Economic uncertainties, such as changes in healthcare policies or global market conditions, could affect consumer demand for JNJ's products.

Expert Predictions for JPM Stock in the Next 5 Years

In the following years, experts anticipate various developments for JPM stock based on industry trends, economic factors, and the strategic direction of the company.

Stock Performance Comparison with Industry Peers

- JPMorgan Chase & Co. is expected to continue outperforming its industry peers due to its strong financial position and diversified business model.

- The company's focus on innovation and digital transformation is likely to give it a competitive edge in the market.

- Investors are optimistic about JPM's ability to capitalize on emerging opportunities and navigate challenges within the financial sector.

Impact of Economic Trends on JPM’s Stock Price

- Economic trends such as interest rates, inflation, and global market conditions can significantly influence JPM's stock price over the next 5 years.

- Changes in regulatory policies and trade agreements may also impact the financial sector and, consequently, JPM's stock performance.

- Analysts suggest that JPM's resilience and adaptability to economic fluctuations will be key factors in determining its stock price trajectory.

JPM’s Strategic Initiatives for Future Growth

- JPMorgan Chase has Artikeld strategic initiatives focused on expanding its digital capabilities, enhancing customer experience, and driving sustainable growth.

- The company's investments in technology, cybersecurity, and innovation are expected to position it for long-term success and market leadership.

- JPM's emphasis on ESG (Environmental, Social, and Governance) principles is seen as a strategic advantage that aligns with evolving market trends and investor preferences.

Analyst Recommendations and Target Prices for JPM Stock

- Analysts generally maintain a positive outlook on JPM stock, with a majority of recommendations leaning towards a "Buy" or "Outperform" rating.

- Target prices for JPM stock vary among analysts, with some predicting significant upside potential based on the company's growth prospects and financial performance.

- Investors are advised to closely monitor analyst reports and updates to make informed decisions regarding their investment in JPM stock.

Concluding Remarks

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

Questions and Answers

What are some key factors influencing JNJ's stock price?

Factors like company performance, market trends, and industry competition play a significant role in influencing JNJ's stock price.

How do economic trends impact JPM's stock price?

Economic trends such as interest rates, inflation, and GDP growth can affect JPM's stock price.