Exploring the intricate relationship between debt financing and company valuations in the stock market opens doors to a realm of financial insight. This article delves into the crucial aspects of how debt financing influences the worth of companies, offering a comprehensive view that sheds light on this complex yet vital topic.

Delve deeper into the factors that play a pivotal role in shaping company valuations through debt financing, and gain a deeper understanding of the risks involved in this financial strategy.

Importance of Debt Financing in Company Valuations

Debt financing plays a crucial role in determining the financial structure of a company and has a significant impact on its overall valuation in the stock market. Let's delve deeper into how debt financing influences company valuations.

Impact on Financial Structure

Debt financing involves raising capital by borrowing funds from external sources, such as banks or bondholders, which results in the company having a mix of equity and debt in its capital structure. This allows companies to leverage their resources and invest in growth opportunities that would otherwise be limited by relying solely on equity financing.

Relationship with Company Valuations

The level of debt a company carries can directly affect its valuation in the stock market. High levels of debt can increase financial risk, leading to higher interest expenses and potential cash flow constraints. This can result in a lower valuation as investors may perceive the company as riskier.

On the other hand, moderate debt levels can be viewed positively by investors as it indicates efficient use of leverage to drive growth and profitability, potentially leading to a higher valuation.

Comparison with Other Forms of Financing

Debt financing differs from equity financing in that it involves repayment obligations and interest payments, which can impact the company's cash flows and profitability. In contrast, equity financing does not require repayment but involves issuing shares, which dilutes ownership. Companies must carefully consider the trade-offs between debt and equity financing to optimize their capital structure and maximize shareholder value.

Factors Influencing Company Valuations Through Debt Financing

Debt financing can significantly impact a company's valuation in the stock market. Several key factors play a crucial role in determining how debt financing affects company valuations.

Role of Interest Rates

Interest rates have a direct impact on company valuations in relation to debt financing. When interest rates are low, companies can borrow money at a lower cost, which can increase their profitability and, in turn, positively influence their valuation. On the other hand, high-interest rates can lead to higher borrowing costs, reducing a company's profitability and potentially lowering its valuation.

Type of Debt

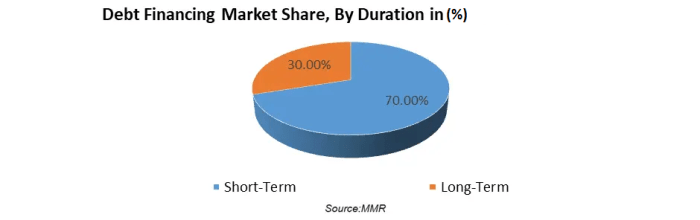

The type of debt a company takes on, whether long-term or short-term, can also influence its valuation. Long-term debt typically involves lower interest rates but requires payments over an extended period, affecting cash flow and long-term financial stability. Short-term debt, on the other hand, may have higher interest rates but provides more flexibility in managing cash flow.

The mix of long-term and short-term debt in a company's capital structure can impact its overall risk profile and, consequently, its valuation in the stock market.

Risks Associated with Debt Financing and Company Valuations

When it comes to utilizing debt financing for company valuations, there are inherent risks that companies need to consider. Excessive debt levels can have a significant impact on how a company is valued in the stock market. It is important for companies to understand these risks and implement strategies to mitigate them effectively.

Impact of Excessive Debt on Company Valuations

Excessive debt can lead to increased financial leverage, which can amplify both gains and losses. In times of economic downturns or financial instability, companies with high levels of debt may struggle to meet their financial obligations. This can result in a decline in the company's stock price and overall valuation.

Investors may perceive companies with high debt levels as riskier investments, leading to a lower valuation in the stock market.

Strategies to Mitigate Risks Associated with Debt Financing

Companies can employ various strategies to mitigate the risks associated with debt financing and protect their valuations. One common approach is to maintain a healthy balance between debt and equity. By diversifying their sources of funding and not relying solely on debt, companies can reduce their vulnerability to market fluctuations and interest rate changes.Another strategy is to regularly monitor and manage debt levels effectively.

Companies should have clear debt repayment plans in place and ensure that they have sufficient cash flow to meet their debt obligations. By staying proactive and addressing debt issues promptly, companies can maintain investor confidence and support their valuations in the stock market.Overall, understanding the risks associated with debt financing and implementing appropriate risk management strategies is crucial for companies looking to enhance their valuations and investor perception in the stock market.

Ultimate Conclusion

In conclusion, the impact of debt financing on company valuations in the stock market is profound and multifaceted. By grasping the dynamics discussed in this article, one can navigate the intricate world of finance with greater clarity and strategic foresight.

FAQ Guide

How does debt financing influence the financial structure of a company?

Debt financing impacts a company's financial structure by introducing liabilities and affecting its equity position, ultimately shaping its valuation.

What are some key factors that determine how debt financing affects company valuations?

Factors such as interest rates, the type of debt (long-term vs. short-term), and the overall debt levels play a significant role in influencing company valuations through debt financing.

What risks are associated with using debt financing for company valuations?

Companies face risks such as increased leverage, interest rate fluctuations, and the potential negative impact of excessive debt on their valuations.

How can companies mitigate risks related to debt financing and valuations?

Companies can employ strategies like diversifying their debt portfolio, managing cash flow effectively, and refinancing debt to mitigate risks associated with debt financing and valuations.