As we delve into the world of Johnson and Johnson Stock Updates: What’s Next for Healthcare Investors, a fascinating narrative unfolds, capturing the attention of readers with its unique insights and compelling storyline.

The following paragraphs will provide a detailed and informative overview of this topic.

Overview of Johnson & Johnson Stock

Johnson & Johnson, founded in 1886, is a multinational corporation known for its significant presence in the healthcare industry. The company has a long history of developing pharmaceuticals, medical devices, and consumer health products that have made a substantial impact on healthcare worldwide.The stock of Johnson & Johnson is considered a stable and reliable investment in the market.

With a strong track record of innovation and success, the company's stock is often viewed as a safe haven for healthcare investors looking for steady returns.

Recent Performance Trends

- Johnson & Johnson's stock has shown resilience in the face of market volatility, consistently outperforming many of its competitors.

- The company's strong financial performance, coupled with a robust pipeline of new products, has contributed to the steady growth of its stock value.

- Despite facing legal challenges and regulatory issues in the past, Johnson & Johnson has managed to maintain investor confidence through effective risk management strategies.

- Analysts predict continued growth for Johnson & Johnson's stock, driven by ongoing research and development efforts in key therapeutic areas.

Factors Influencing Johnson & Johnson Stock

Factors influencing Johnson & Johnson's stock price can vary from regulatory changes to product launches and recalls. These factors play a crucial role in determining the company's financial performance and overall market sentiment towards the stock.

Regulatory Changes Impact

Regulatory changes can have a significant impact on Johnson & Johnson's stock price. For instance, any new regulations related to healthcare policies, drug approvals, or product safety standards can directly affect the company's operations and profitability. Investors closely monitor regulatory updates to assess the potential risks and opportunities associated with Johnson & Johnson's stock.

Product Launches or Recalls

Product launches and recalls can also influence Johnson & Johnson's stock value. Successful product launches, especially for innovative healthcare solutions or medications, can boost investor confidence and drive the stock price higher. On the other hand, product recalls due to safety concerns or regulatory issues can lead to a decline in the stock price as investors worry about the company's reputation and financial implications.

Market Comparisons for Healthcare Investors

When it comes to investing in the healthcare sector, comparing the stock performance of companies like Johnson & Johnson with its competitors is crucial for making informed decisions. Industry trends play a significant role in shaping investment strategies, and understanding why healthcare investors might prefer Johnson & Johnson over other healthcare stocks can provide valuable insights.

Comparing Stock Performance

- Johnson & Johnson has historically been a stable performer in the healthcare sector, with consistent growth and dividends for investors.

- Compared to competitors like Pfizer and Merck, Johnson & Johnson has shown resilience during market fluctuations and economic uncertainties.

- Investors often look at key financial metrics such as revenue, earnings per share, and return on equity to assess the performance of healthcare stocks.

Impact of Industry Trends

- Technological advancements, regulatory changes, and healthcare policies can significantly influence the stock prices of companies in the sector.

- Investors closely monitor trends in pharmaceuticals, medical devices, and consumer healthcare to gauge the potential growth opportunities and risks.

- Global health crises, like the COVID-19 pandemic, can have both short-term and long-term effects on healthcare stocks, including Johnson & Johnson.

Why Choose Johnson & Johnson

- Johnson & Johnson's diversified portfolio across pharmaceuticals, medical devices, and consumer health products offers investors a balanced exposure to different segments of the healthcare industry.

- The company's strong research and development pipeline, along with its global presence, provide a competitive advantage in the market.

- Johnson & Johnson's commitment to innovation, sustainability, and corporate responsibility resonates with socially conscious investors looking for long-term growth potential.

Future Outlook for Johnson & Johnson Stock

The future outlook for Johnson & Johnson stock is a topic of interest for many healthcare investors. As a well-established company in the healthcare industry, Johnson & Johnson has the potential for growth opportunities, but also faces challenges that could impact its stock price.

Let's delve into what the future may hold for Johnson & Johnson stock.

Potential Growth Opportunities

- Johnson & Johnson's diversified portfolio: With a wide range of products in pharmaceuticals, medical devices, and consumer health, Johnson & Johnson has the opportunity to capitalize on various segments of the healthcare market.

- Investments in research and development: Continued innovation and investment in R&D can lead to the development of new products and treatments, driving growth for the company.

- Global expansion: Expanding into emerging markets and reaching a wider customer base can open up new growth opportunities for Johnson & Johnson.

Upcoming Challenges

- Regulatory hurdles: Increasing regulations in the healthcare industry could pose challenges for Johnson & Johnson in terms of product approvals and compliance.

- Competition: Intense competition in the healthcare sector may impact Johnson & Johnson's market share and pricing strategies.

- Litigation risks: Ongoing legal battles and lawsuits against the company could affect its financial performance and reputation.

Expert Opinions and Analyst Forecasts

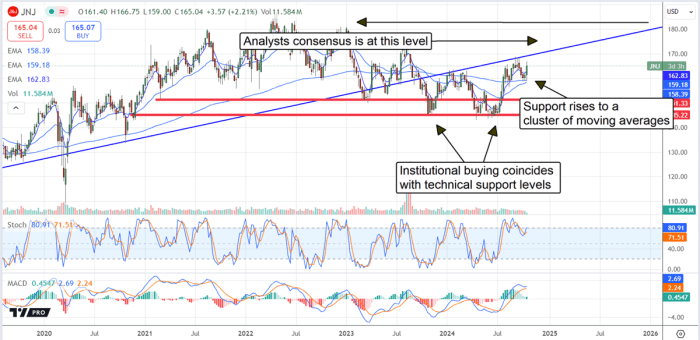

Johnson & Johnson stock is closely monitored by analysts and experts in the financial industry. While forecasts can vary, many experts believe that Johnson & Johnson's strong market position and focus on innovation could drive future growth. Analysts often consider factors such as earnings reports, market trends, and industry developments to predict the trajectory of Johnson & Johnson stock.

Closing Notes

In conclusion, this discussion on Johnson and Johnson Stock Updates: What’s Next for Healthcare Investors offers a comprehensive summary, leaving readers with valuable insights and key takeaways to ponder upon.

FAQ Overview

What factors influence Johnson & Johnson's stock price?

Factors include regulatory changes, product launches or recalls, and industry trends.

Why might healthcare investors choose Johnson & Johnson over other healthcare stocks?

Investors might choose Johnson & Johnson for its strong market presence, historical performance, and potential growth opportunities.

What are some recent performance trends of Johnson & Johnson's stock?

Recent trends show steady growth and resilience in the market despite challenges.