Kicking off with Revenue Based Financing: Why Investors Are Paying Attention, this opening paragraph is designed to captivate and engage the readers, providing a compelling overview of the topic.

The following paragraph delves into the key features and differences of Revenue-Based Financing compared to traditional methods, along with examples of businesses that benefit from it.

What is Revenue-Based Financing?

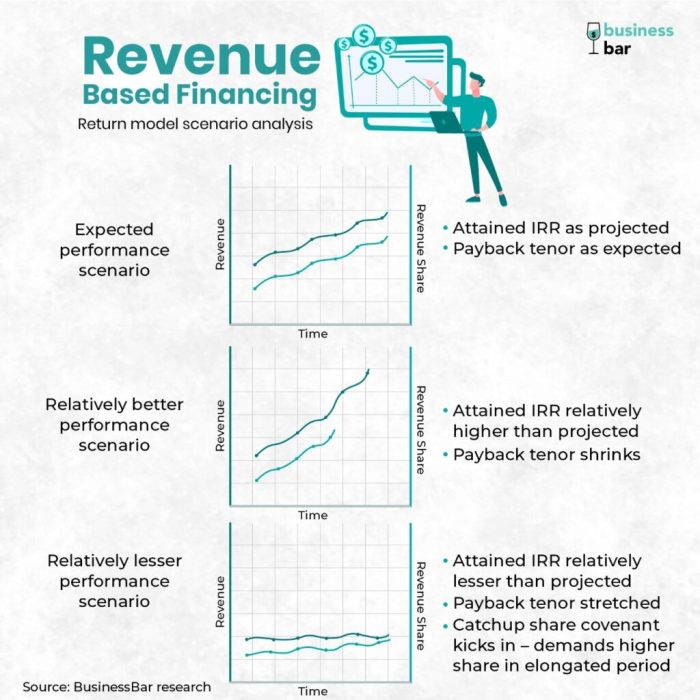

Revenue-Based Financing is a form of alternative financing where a business receives funding in exchange for a percentage of its future revenue. Unlike traditional loans, Revenue-Based Financing does not require fixed payments but instead takes a percentage of the business's revenue until a predetermined cap or multiple of the investment amount is reached.

Key Features of Revenue-Based Financing

- Flexible repayment structure based on a percentage of future revenue

- No fixed payments or interest rates

- Payments adjust with the business's revenue performance

- Investors share in the business's success

Differences from Traditional Financing

- Revenue-Based Financing does not require collateral like traditional loans

- Repayment is directly tied to the business's revenue, aligning the interests of the investor and the business

- There is no fixed repayment term, providing more flexibility for the business

Examples of Businesses Benefiting from Revenue-Based Financing

- Tech startups with high growth potential but irregular revenue streams

- Subscription-based businesses with predictable recurring revenue

- E-commerce businesses looking to scale quickly without taking on traditional debt

Advantages of Revenue-Based Financing

Revenue-Based Financing offers several advantages for both investors and startups/small businesses.

Advantages for Investors:

- Steady returns: Investors receive a percentage of the company's revenue, providing a predictable income stream.

- Lower risk: Since repayments are tied to revenue, investors have some level of protection even if the business faces challenges.

- Potential for high returns: If the company performs well, investors can benefit from a portion of the increased revenue.

Benefits for Startups and Small Businesses:

- No equity dilution: Unlike traditional equity funding, Revenue-Based Financing does not require giving up ownership stakes in the business.

- Faster access to funds: The approval process is typically quicker, allowing startups to secure capital more efficiently.

- Flexibility: Repayments are based on revenue, so businesses have more flexibility during lean periods compared to fixed monthly payments.

Flexibility Compared to Other Funding Options:

- Unlike traditional loans, Revenue-Based Financing does not require fixed monthly payments, providing more breathing room for businesses.

- Compared to equity financing, where ownership stakes are at stake, Revenue-Based Financing allows businesses to maintain control and independence.

- Compared to venture capital, which often comes with high expectations for growth, Revenue-Based Financing offers a more sustainable and pragmatic approach to funding.

Risks and Challenges of Revenue-Based Financing

Revenue-Based Financing, while offering many advantages, also comes with its fair share of risks and challenges that investors need to consider. Let's delve into some of the potential pitfalls associated with this financing model.

Default Risk

Revenue-Based Financing exposes investors to the risk of default if the business fails to generate the projected revenue. In such cases, the investor may not recoup the full investment, leading to financial losses.

Lack of Equity Ownership

Unlike traditional equity financing, Revenue-Based Financing does not provide investors with ownership stakes in the business. This lack of equity can limit the investor's ability to influence key decision-making processes within the company.

Impact on Cash Flow

The repayment structure of Revenue-Based Financing, where payments are tied to revenue, can put pressure on a company's cash flow. During lean periods, when revenue is low, the business may struggle to meet its repayment obligations.

Market Volatility

Fluctuations in the market can directly impact a company's revenue, affecting the investor's returns. Economic downturns or industry-specific challenges can pose significant challenges for businesses relying on Revenue-Based Financing.

Not Suitable for All Businesses

Revenue-Based Financing may not be the ideal choice for businesses with irregular revenue streams or those in the early stages of development. Start-ups or companies with unpredictable revenue patterns may find it difficult to commit to fixed repayment schedules.

Regulatory Risks

Regulatory changes or legal issues can also pose risks for investors engaged in Revenue-Based Financing. Changes in laws or compliance requirements may impact the financial stability of businesses, affecting the investor's returns.

Current Trends and Growth of Revenue-Based Financing

Revenue-Based Financing (RBF) has been gaining significant traction in the investment landscape due to its unique approach to funding startups and small businesses. Investors are increasingly interested in RBF as it offers a more flexible and founder-friendly alternative to traditional equity funding.

Industry Adoption of Revenue-Based Financing

- Technology Startups: Tech companies have been quick to embrace RBF as it allows them to access capital without surrendering ownership or control.

- E-Commerce Businesses: Online retailers find RBF appealing as it aligns repayment with revenue streams, making it less risky compared to traditional loans.

- SaaS Companies: Software as a Service (SaaS) providers benefit from RBF's revenue-sharing model, which allows them to scale their operations without taking on excessive debt.

Impact on Investment Landscape

- Shift in Focus: Investors are shifting towards RBF due to its emphasis on sustainable growth and profitability, rather than just rapid expansion at all costs.

- Diversification of Portfolios: RBF offers investors a new asset class that provides steady returns based on the performance of the funded companies.

- Increased Competition: As RBF gains popularity, more players are entering the market, offering a wider range of financing options for entrepreneurs.

Last Point

In conclusion, Revenue-Based Financing is gaining traction among investors for various reasons discussed in this article, reshaping the investment landscape in exciting ways.

Question & Answer Hub

What is Revenue-Based Financing?

Revenue-Based Financing is a funding model where investors receive a percentage of the company's revenue until a predetermined amount is repaid.

What are the advantages of Revenue-Based Financing for investors?

Investors benefit from regular returns based on revenue, lower risk compared to traditional equity investments, and alignment of interests with the business.

What are the risks of Revenue-Based Financing?

Potential risks include slower growth for businesses due to revenue-sharing obligations and challenges in scaling up without affecting profitability.

Why is Revenue-Based Financing gaining popularity?

It offers flexibility for startups and small businesses, allows for faster access to capital, and provides a more sustainable funding option in certain situations.