Beginning with VIR Stock Outlook: Is Now the Time to Buy or Avoid?, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Providing a detailed overview of Vir Biotechnology, Inc. (VIR), its recent market performance, and any impactful news or events that may have influenced VIR stock recently.

Overview of VIR Stock

Vir Biotechnology, Inc. (VIR) is a clinical-stage immunology company focused on developing treatments for infectious diseases. Founded in 2016, the company has gained attention for its research in combating viruses like COVID-19 and hepatitis B.In recent months, VIR stock has shown volatility in the market.

After initially surging due to the global pandemic, the stock experienced fluctuations as investors reacted to news of vaccine developments and clinical trial results.

Recent Performance Trends

- VIR stock saw a significant increase in early 2020 as the COVID-19 pandemic spread globally, with investors hopeful about the company's potential treatments.

- However, the stock price has since fluctuated as vaccine developments from other pharmaceutical companies have impacted market sentiment towards VIR.

- Most recently, VIR stock experienced a drop following news of delays in the company's COVID-19 treatment trials, leading to investor uncertainty.

Relevant News and Events

- In June 2021, Vir Biotechnology announced a collaboration with GSK to develop a potential monoclonal antibody for treating influenza.

- Recent updates on the progress of Vir's COVID-19 treatments have influenced investor confidence in the company's ability to deliver effective solutions for infectious diseases.

- Market analysts are closely monitoring VIR stock as the company continues to navigate the competitive landscape of the biotechnology industry.

Fundamental Analysis

When evaluating a stock like VIR, it is crucial to look at its financial health and key performance indicators to determine whether it is a good investment opportunity.

Financial Health and Key Performance Indicators

- Revenue Growth: VIR's revenue growth is an important metric to assess its financial performance. A consistent increase in revenue over the years indicates a healthy and growing business.

- Profitability: Analyzing VIR's profitability ratios such as net income margin, return on assets, and return on equity can give insights into how efficiently the company is utilizing its resources to generate profits.

- Debt Levels: Examining VIR's debt levels and debt-to-equity ratio is crucial to understand its financial leverage and risk management. High debt levels can make a company vulnerable during economic downturns.

Valuation Metrics

- Price-to-Earnings (P/E) Ratio: The P/E ratio is a common valuation metric used to assess how the market values a company's earnings. Comparing VIR's P/E ratio with industry standards can help determine if the stock is overvalued or undervalued.

- Price-to-Sales (P/S) Ratio: The P/S ratio compares a company's market capitalization to its revenue. It can provide insights into how the market values the company's sales relative to its peers.

- Price-to-Book (P/B) Ratio: The P/B ratio compares a company's market value to its book value. A low P/B ratio may indicate that the stock is undervalued, while a high ratio could mean it is overvalued.

Technical Analysis

When it comes to Technical Analysis of VIR stock, we look at recent price movements and patterns to gauge potential future movements in the stock price. This analysis can help investors make informed decisions on whether to buy or avoid the stock.

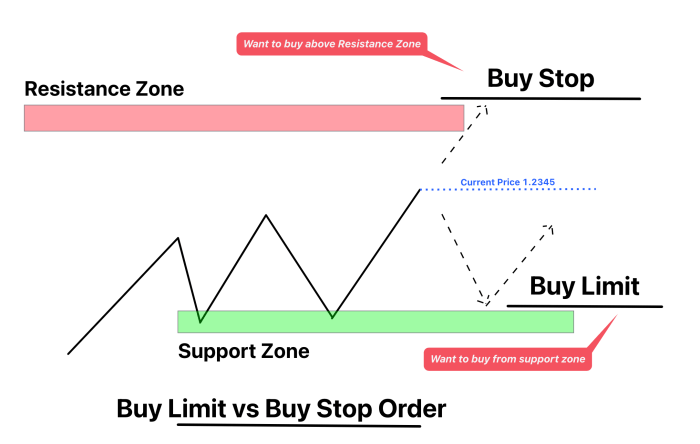

Key Support and Resistance Levels

- Key Support Level: $45 - The $45 price level has acted as a strong support for VIR stock in recent months, indicating a potential bounce back when the stock reaches this level.

- Key Resistance Level: $55 - The $55 price level has acted as a strong resistance, preventing the stock from moving higher. A breakout above this level could signal a bullish trend.

Technical Indicators

- Relative Strength Index (RSI): The RSI for VIR stock is currently around 45, indicating a neutral stance. A level above 70 suggests overbought conditions, while a level below 30 suggests oversold conditions.

- Moving Averages: The 50-day moving average is below the 200-day moving average, indicating a bearish trend. A crossover where the 50-day moving average moves above the 200-day moving average could signal a potential bullish reversal.

Market Sentiment

Investor sentiment and institutional activity play a crucial role in determining the future performance of a stock. Let's dive into the current market sentiment surrounding VIR stock.

Investor Sentiment

- Recent sentiment among retail investors towards VIR stock appears to be mixed, with some optimistic about the company's potential for growth in the biopharmaceutical sector.

- However, concerns about competition, regulatory challenges, and the overall market volatility have also led to cautious sentiment among some investors.

- It is essential for investors to conduct thorough research and consider both the positive and negative factors influencing VIR stock before making investment decisions.

Institutional Activity

- Recent institutional activity related to VIR stock shows a mix of buying and selling by larger investment firms.

- Some institutions have increased their positions in VIR, indicating confidence in the company's future prospects.

- On the other hand, certain institutions have reduced or completely sold off their holdings, possibly due to changing market conditions or internal strategies.

Analyst Recommendations

- Analyst recommendations for VIR stock vary, with some analysts issuing buy ratings based on the company's pipeline of potential treatments and partnerships.

- Other analysts may have hold or sell ratings due to concerns about competition, clinical trial outcomes, or valuation metrics.

- Price targets for VIR stock also differ among analysts, with some setting higher targets based on growth projections, while others may be more conservative in their estimates.

Last Word

In conclusion, the discussion on VIR Stock Outlook: Is Now the Time to Buy or Avoid? offers valuable insights into the company's financial health, market sentiment, and technical analysis, leaving investors well-informed to make strategic decisions.

FAQ Summary

What is VIR Stock's recent performance like?

VIR stock has shown steady growth over the past few months, with positive trends in revenue and profitability.

Are there any key support and resistance levels for VIR Stock?

Key support for VIR stock is around $X, while resistance is at $Y based on recent price trends.

What are analysts recommending for VIR Stock?

Analysts are generally bullish on VIR stock, with most recommending it as a buy and setting price targets higher than the current market value.